Hedge is formed in order to lessen or eliminate economic exposure. A recognised asset or liability 2.

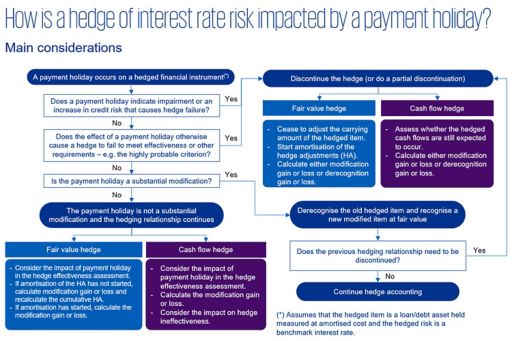

How Is A Hedge Of Interest Rate Risk Impacted Kpmg Global

This is a very important distinction to understand before you make the decision to become a Client of the Agent andor Agency.

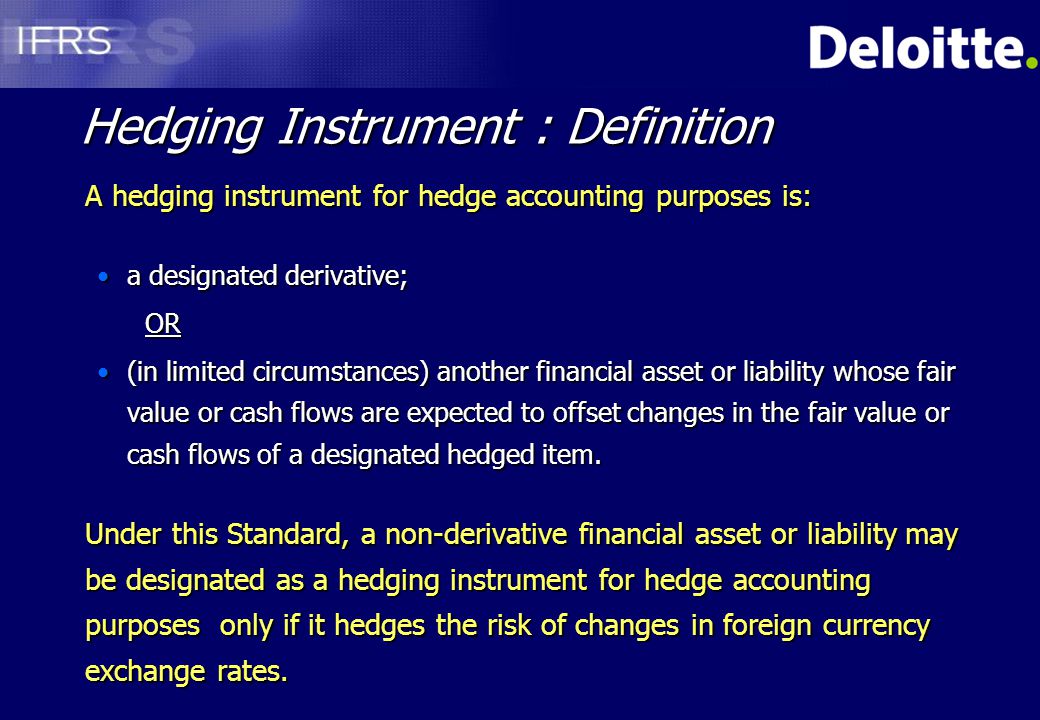

. If the company has a designated fair value hedge where the hedged item is taxed in line with its accounting treatment the tax treatment of the derivative is to simply. IFRS 9 contains no restrictions regarding the circumstances in which a derivative can be designated as a hedging instrument provided the hedge accounting criteria are met except for some written options. A firm commitment foreign currency risk only IFRS 9654 and could affect PL IFRS 9652b.

The total change in the price of the futures contract since year-end is 10000. A fair value hedge may be designated for a firm commitment not recorded or foreign currency cash flows of a recognized asset or. Under normal accounting we would still affect PL with the net amount.

A highly probable forecast transaction or 3. It concerned with borrowing in the foreign currency to match the cash flow patterns. 1 the substantial cost of documentation and ongoing monitoring of designated hedges.

Accounting for currency basis spreads 17 5. Hedging with forward contracts 16 46. 17 Apr 2018 1 MINUTE READ.

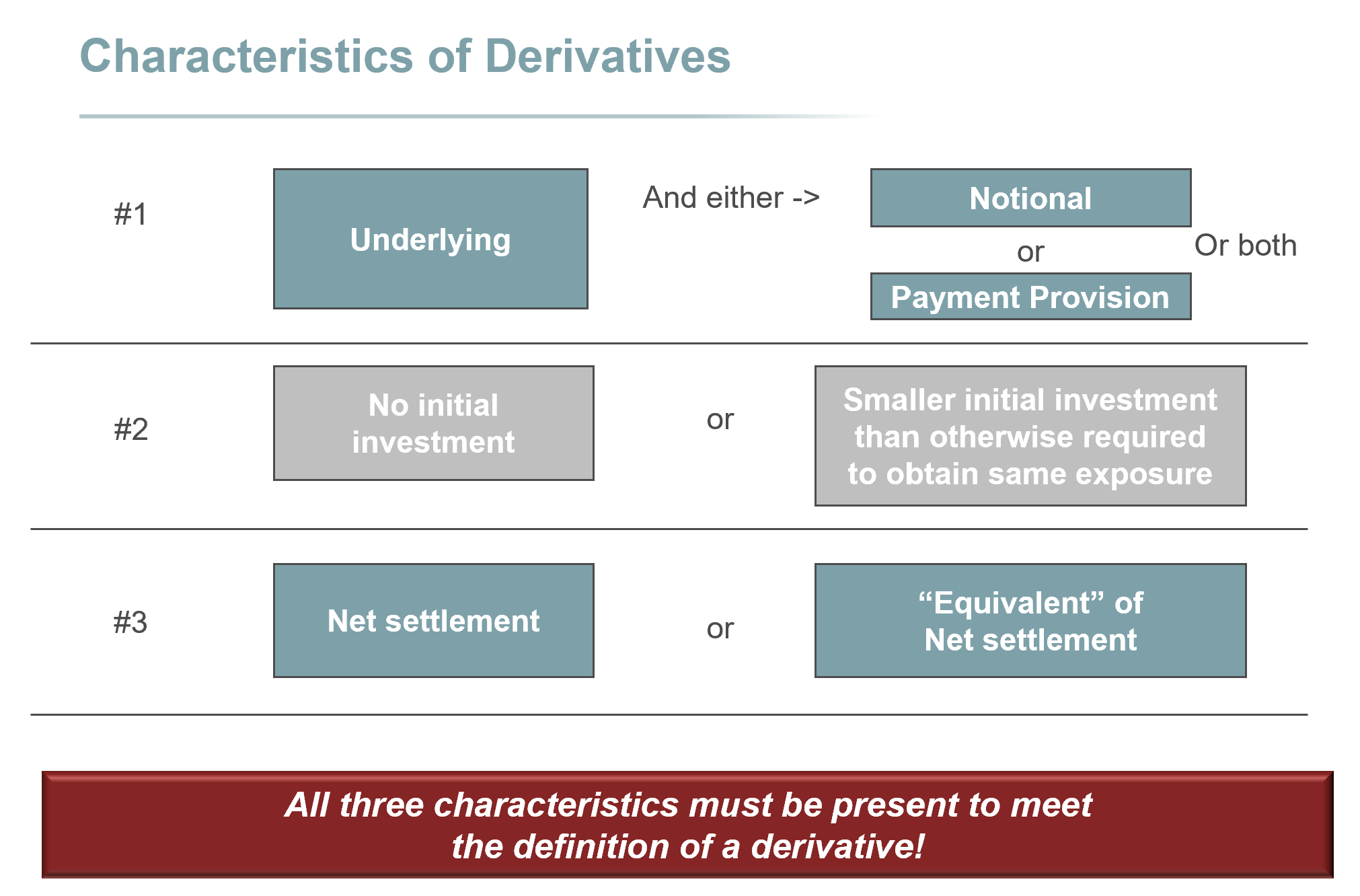

The proposed standard simplifies the accounting for hedging activities and generally increases the appeal of hedge accounting. Embedded derivatives 15 44. I Financial assets carried at amortized cost.

2 What would be the difference if we apply hedge accounting and if we do not apply hedge accounting because I cant see a difference ie under hedge accounting the net amount between what we pay and what we receive will go to PL basically the non-effective portion. Annual Report 2019-20 2102 Subsequent measurement a. Cash flow hedge is a hedge of the exposure to variability in cash flows that is attributable to a particular risk associated with all or a component of 1.

A not designated beneficiary is a classification for certain nonperson entities who inherit a retirement account. Hedging with purchased options 15 45. January 15 202 To recognize the settlement of the futures contract hedging instrument.

2 the availability of natural hedges that can be highly effective. The Disclosure also explains the difference between a Designated Agency and a Non-Designated Agency. This assessment encompasses operational aspects such as the hedge effectiveness test as well as the eligibility of items such as risk components of non-financial items that can be designated in hedging relationships.

For financial entities the situation is more complex. In reviewing the reports of a large sample of firms we find the following four explicit reasons why companies may decide not to designate derivatives as accounting hedges. Non-derivative financial instruments measured at fair value through PL 15 43.

And ongoing monitoring of. Hedge accounting has not been achi eved in the past. Designated Hedge Agreement means any Hedge Agreement other than a Commodity Hedge Device to which any Credit Party is a party and as to which a Lender or any of its affiliates is a counterparty that pursuant to a written instrument signed by Agent has been designated as a Designated Hedge Agreement so that such Credit Partys counterpartys credit exposure.

A particular type of hedging transaction is having the objective of managing the foreign. Therefore 3000 hedge ineffectiveness. These nonperson entities are.

Designated Hedge Agreement means any Hedge Agreement other than a Commodities Hedge Agreement to which the Borrower or any of its Subsidiaries is a party and as to which a Lender or any of its Affiliates is a counterparty that pursuant to a written instrument signed by the Administrative Agent has been designated as a Designated Hedge Agreement so that the. A financial asset is subsequently measured at amortized cost if it is held within a business model whose objective is to hold the asset in order to collect contractual cash flows and the contractual terms of. Designated Fair value hedge.

A Non-Designated Agency real estate firm owes a duty of loyalty to a client which is shared by all agents of the firm. The gain or loss on a derivative instrument not designated a hedging instrument appears in current income. Derivative financial instruments 15 42.

CHARLES Ill March 16 2022 PRNewswire --To help patients suffering from a substance use disorder find facilities that deliver quality treatment and care Blue Cross and Blue. For hedge accounting purposes only assets liabilities firm commitments or highly probable forecast transactions with a party external to the reporting entity can be designated as hedged items. Detail hedge accounting is described under IAS 39- Financial Instruments.

Entity A has designated the swap as a hedge of the changes in fair value of the fixed-rate note due to changes in the designated benchmark interest rate and Libor as the benchmark rate risk being hedged. An entry to OCI is made to reduce the cash flow reserve by 7000 ie 95000 88000. A recent Court Judgment has brought some additional and important clarification on how non-designated heritage assets NDHAs in Conservation Areas should be dealt with in the context of planning decisions.

Hedge accounting can be applied to transactions between entities in the same group only in the individual or separate financial statements of those entities and not in the consolidated. Non-designated heritage assets in Conservation Areas. I have Designated son and Non-Designated Beneficiaries 3 charities to my traditional IRA.

This is a hedge of the fair value of an asset or liability in a purchase sale transaction or firm commitment at a definite price. I would like to clarify that my personal representative under my will would have until 1231 of the year after my death to split the IRA in two separate IRAs where one of the new IRAs listed my son as the sole beneficiary making him a Designated Beneficiary and the other. Non-derivative financial instruments measured at.

Therefore Entity A qualifies to use the shortcut method. What can be designated as hedging instruments. 3 a new accounting standard that.

A cash flow hedge may be designated for a highly probable forecasted transaction a firm commitment not recorded on the balance sheet foreign currency cash flows of a recognized asset or liability or a forecasted intercompany transaction.

Derivatives And Hedging Gaap Dynamics

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Need To Know The Upcoming Hedging Standard

Agenda Scope And Definitions Ias 32 Ias Ppt Download

0 comments

Post a Comment